Has anyone ever wondered how crypto exchanges turn millions of trades, tokens, and transactions into sustainable profits, often even during market downtime?

Behind every buy and sell button lies a carefully designed revenue engine that powers the entire platform. Crypto exchanges are just trading venues; they are financial ecosystems built on smart monetization strategies. Understanding these cryptocurrency exchange revenue models reveals how platforms scale, remain profitable, and compete in a fast-moving digital economy, making it essential knowledge for founders, investors, and curious traders. And if you are still wondering how crypto exchanges make money? Then this blog gives you exactly what you might need, and by the end, you will gain clarity.

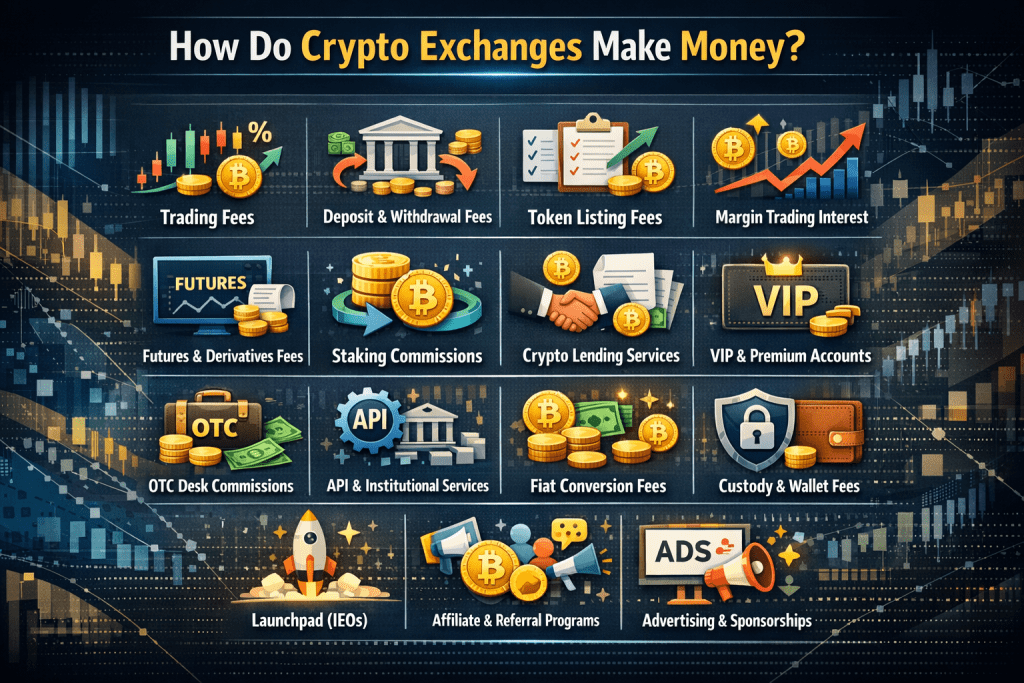

How Do Crypto Exchanges Make Money?

Cryptocurrency exchanges generate revenue through multiple income streams, including trading fees, withdrawal charges, token listings, and premium services. Understanding these crypto exchange revenue models helps users make informed decisions when selecting trading platforms for their digital asset investments.

1. Trading Fees

Cryptocurrency exchanges charge small percentages on every buy and sell transaction that happens; it typically ranges between 0.1% and 0.5% of the total trade value.

2. Deposit & Withdrawal Fees

Platforms collect fees when users deposit fiat currency or withdraw cryptocurrency to external wallets, which fully cover blockchain network transaction costs.

3. Listing Fees for New Tokens

New cryptocurrency projects pay substantial listing fees that can be charged anywhere between $50,000 and $1 million for exposure on popular exchange platforms worldwide.

4. Margin Trading & Lending Interest

Cryptocurrency exchanges generate interest revenue by providing traders or users with funds to establish leveraged positions through their daily or hourly interest rate charges.

5. Futures & Derivatives Trading Fees

Cryptocurrency futures contracts, options, and perpetual swaps generate higher trading fees compared to standard spot trading on exchange platforms, making it another way to earn money.

6. Staking Commissions

Crypto trading platforms can take a certain percentage cut from staking rewards earned by users who lock cryptocurrencies for passive income generation opportunities.

7. Crypto Lending Services

In the crypto lending services, the trading platforms earn money by borrowing cryptocurrencies from users at lower rates and lending to borrowers at higher interest rates.

8. VIP Subscriptions

Premium membership programs offer reduced trading fees, together with priority customer support and exclusive features for monthly or annual subscription payments.

9. OTC Desk Fees

The over-the-counter trading desks create their revenue through commission charges, which they assess when they handle large-scale private cryptocurrency transactions between institutional buyers and sellers.

10. API Access & Institutional Services

The exchanges impose monthly charges on institutional clients and algorithmic traders who require advanced API access, enhanced data feeds, and priority execution services.

11. Fiat Conversion Fees

The process of converting traditional currencies such as USD and EUR into cryptocurrencies results in exchange fees, making money through payment processing and banking partnership expenses.

12. Custody & Wallet Service Fees

The institutional clients who use secure cryptocurrency custody solutions must pay monthly management costs depending on their total assets under management.

13. Launchpads (IEOs)

In the exchange, one can make revenue through Initial Exchange Offerings, new blockchain projects can raise capital while exchanges gain revenue from listing fees and token distribution.

14. Affiliate Programs

The exchanges provide partners with commission payments for successfully referring new users, who then generate trading revenue for the exchanges throughout their entire trading relationship.

15. Advertising

The cryptocurrency projects and blockchain companies make payments for banner advertising, featured listings, and promotional placements, which they use on exchange platforms without interruption.

The revenue sources used by crypto exchanges extend beyond their fundamental trading fees, enabling them to establish profitable business operations.

Additional Revenue Opportunities Through Cryptocurrency Exchange

The crypto exchange applications create new revenue streams through their in-app features and premium tools to improve user engagement. The development of dedicated mobile applications for cryptocurrency trading platforms establishes new revenue streams that exceed the financial benefits of conventional web-based trading platforms.

1. In-App Premium Features

Mobile apps provide users with access to premium features like advanced charting tools, real-time alerts, and market analysis through a monthly subscription model.

2. Push Notification Advertising

The exchanges generate revenue by delivering sponsored push notifications to inform app users about new token launches, trading signals, and partner promotions.

3. White Label App Licensing

The company earns recurring licensing fees and development revenue streams by selling its customizable white-label mobile applications to other exchanges and brokers.

4. App-Exclusive Token Sales

The app-driven distribution of new token sales allows users to access exclusive investment opportunities, resulting in app downloads and platform allocation fees.

5. Paid Educational Content & Courses

The in-app cryptocurrency trading courses, webinars, and expert tutorials generate revenue through one-time purchases or subscription-based learning access models.

6. Gamification & Trading Competitions

Mobile trading contests, leaderboard competitions, and reward-based challenges generate additional income for exchanges while creating opportunities for user engagement through their entry fees.

Cryptocurrency exchange apps create distinct revenue streams that cannot be found on web platforms. The app-specific revenue channels generate higher profits while making it easier for users to navigate the platform and use its various features.

How Profitable is it to Run a Cryptocurrency Exchange?

Running a cryptocurrency exchange can be highly profitable with proper execution and market positioning. Established platforms can make monthly revenues worth millions by using multiple income sources, including trading fees, listings, and premium services. Your profitability depends on trading volume, user base size, and competitive fee structures implemented and this is the best chance to start a cryptocurrency exchange business. Large exchanges like Binance and Coinbase report billions in annual profits while smaller platforms earn modest returns initially.

Success requires substantial upfront investment in technology, security infrastructure, regulatory compliance, and marketing efforts. The crypto exchange business offers excellent profit margins once operational costs stabilize and user acquisition grows consistently. However, intense competition and regulatory challenges mean profitability timelines vary significantly across different markets and regions globally.

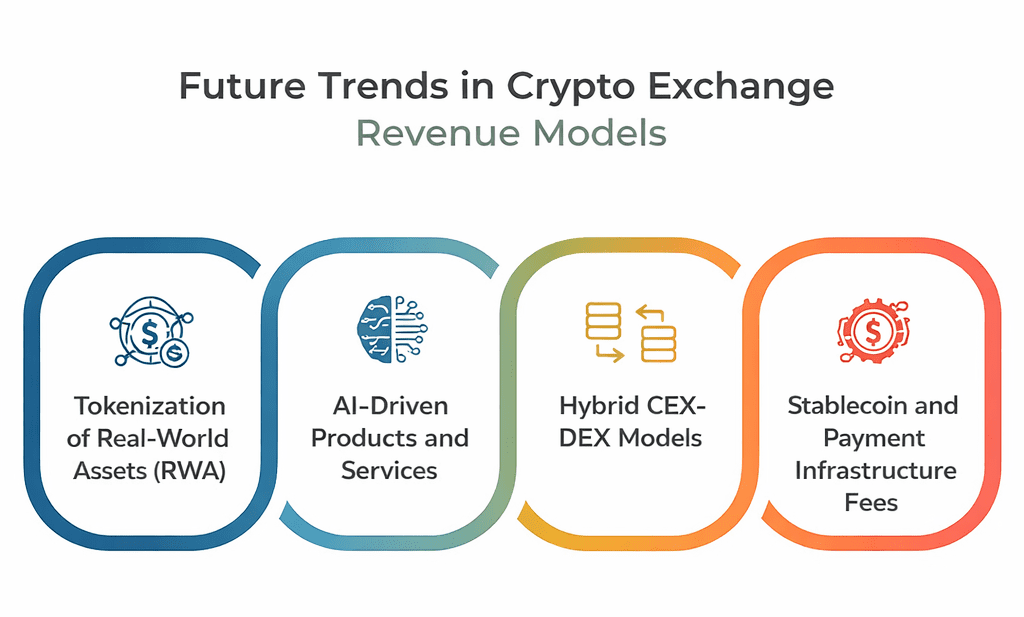

Future Trends in Crypto Exchange Revenue Models

The future of crypto exchange revenue models will shift beyond basic trading fees, focusing on innovation, broader financial services, and deeper integration with traditional finance and digital ecosystems.

Tokenization of Real-World Assets (RWA)

Cryptocurrency exchanges enable trading of tokenized bonds, real estate, and commodities, unlocking new fees from diverse asset classes and institutional participation.

AI-Driven Products and Services

The platform generates revenue through its AI trading bots, analytics tools, risk assessment instruments, and APIs to enhance user decision-making and automated processes.

Hybrid CEX-DEX Models

Exchanges combine centralized matching with on-chain settlement to create active revenue streams through custody fees and decentralized trade execution premiums.

Stablecoin and Payment Infrastructure Fees

Cross-border payments depend on stablecoins operating as essential payment rails, creating additional revenue through settlement processes, currency conversion, and liquidity services.

Future revenue models will emphasize diversified financial services, technological innovation, and interoperability, ensuring sustainable growth beyond simple trading fees by capturing institutional and mainstream economic activity.

In Conclusion

The digital asset trading sector requires businesses to learn about cryptocurrency exchange revenue models. Successful platforms achieve long-term profitability through multiple income sources, including trading fees and premium services, and their unique operational capabilities.

Cryptiecraft, a skilled crypto exchange software development company, creates secure and expandable cryptocurrency exchange platforms that include extensive functionalities that meet your business requirements. The advanced trading engines, security systems, regulatory compliance solutions, and revenue optimization techniques define our complete service offerings. Cryptiecraft enables you to turn your crypto exchange concept into a successful business through our established development expertise.