In the rapidly changing world of digital finance, Margin Trading Exchange Development has gone from being a specialized niche. It is becoming a key component of the global crypto economy. Market data shows that derivatives and leveraged trading together comprise about 75% of trading volume. This often amounts to several trillion dollars in monthly activity.

For entrepreneurs, building a reliable margin trading exchange is highly profitable. Margin trading permits an investor to buy more securities than they have. It is allowed by borrowing funds from the broker. By adding your current holdings up as collateral, you get the leverage to boost your potential profits. And it also greatly increases the possibility of your losses. With the increasing competition in global markets, margin trading platform demand is increased.

So, in this blog we will take a look in detail about margin trading exchange, its development, benefits and more.

What is a Margin Trading Exchange?

A margin trading exchange is a cryptocurrency trading platform that gives users the option to trade their assets with the help of borrowed funds and thus to enlarge their market exposure more than their original capital. The traders give collateral, which is called margin, to open their positions and need to keep the necessary levels to avoid being liquidated. These exchanges grant access to the higher potential of profits. At the same time, it brings greater risk, requiring a strategy & market observation.

To create a successful margin trading exchange, the development of high-quality margin trading exchange software with sophisticated risk management, real-time pricing, and liquid order books is necessary. One requires regulatory compliance, cybersecurity, and easy-to-use interfaces. The best margin trading exchange solutions offer scalability, multi-asset support, and automatic margin calls. These features keep exchanges stable and profitable, even during market swings.

Margin Trading Exchange Development

Margin Trading Exchange Development refers to the end-to-end process of building a high-performance digital asset platform that enables users to trade using leveraged funds. This software has a strong matching engine and an advanced lending layer. This lets traders borrow against their assets (collateral) to take larger positions.

A top margin trading exchange offers fast order matching, many multi-asset trading pairs, and a scalable system for heavy trading loads. Security features such as fund custody, encryption, and other measures protect the users. At last, margin trading exchange development focuses on building a reliable, transparent platform for traders.

Advantages of Margin Trading Exchange Software

These are some of the advantages one can gain when creating a margin trading platform. It increases profits but also controls the market by allowing traders to buy more.

Profit Potential

The users are able to take larger positions in the market with a smaller amount of money. Hence, their profits from successful trades increase to a great extent.

New Source of Revenue

Build a profitable margin trading exchange to get a steady income. It can be from the lending fees which charges the traders borrowing money for leveraged positions.

More Users and More Income

The provision of leverage draws in professional traders dealing in large volumes. It, in turn, increases the platform’s liquidity and the total fees.

Diverse Revenue Streams

Gain income through liquidation penalties, withdrawal fees, and tiered interest on different margin trading pairs.

Hence, while choosing to develop margin trading exchange software, choose faster operations. Now, let us discuss the key elements that drive our exchange architecture.

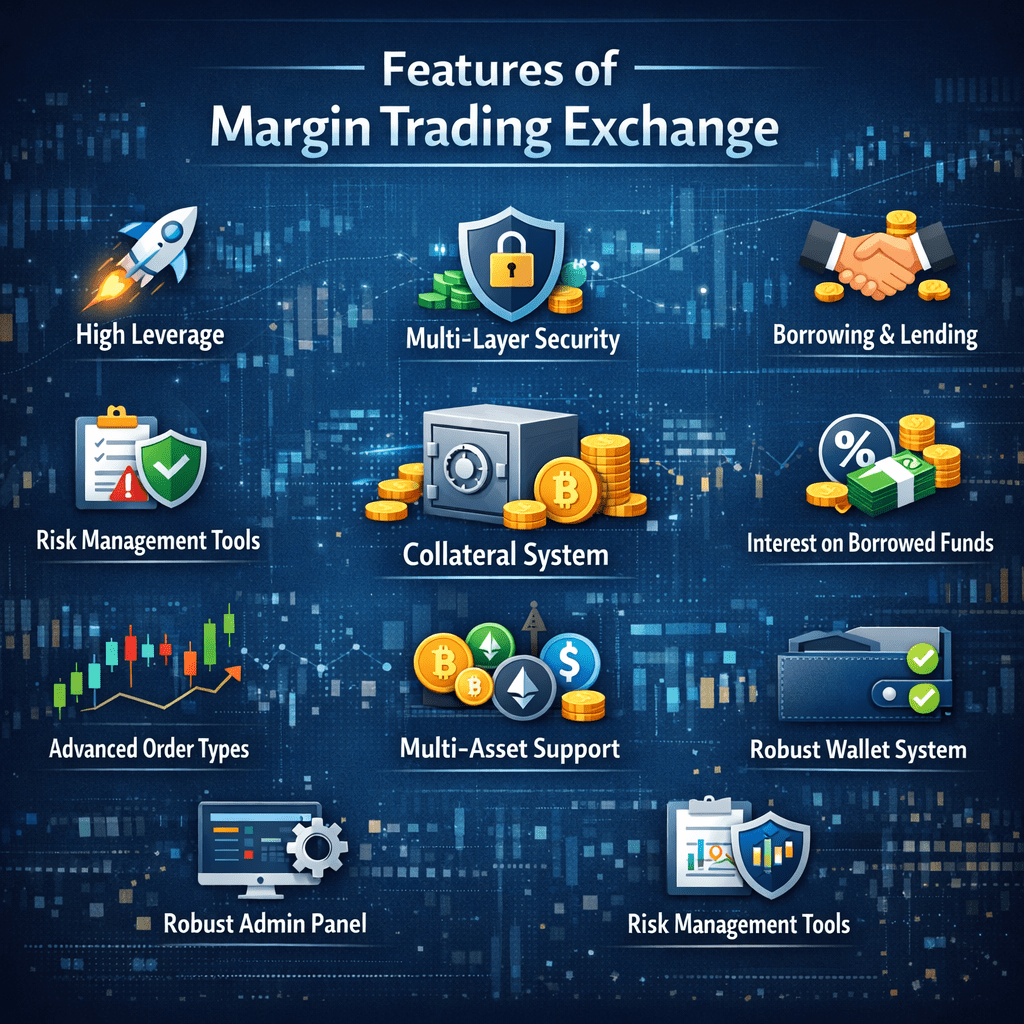

Features Of Our Margin Trading Exchange Development

While starting the best margin trading exchange development, include sophisticated features. It is suitable for traders & provides the most returns and risk protection mechanisms.

High Leverage

Traders can amplify their trading positions up to 100 times. They can control much bigger positions, but with minimal capital investment.

Multi-layer Security

The enterprise-grade encryption, two-factor authentication, cold storage, and real-time monitoring ensure protection. It prevents unauthorized access & threats.

Borrowing and Lending

With a peer-to-peer lending marketplace, traders borrow funds & lenders earn competitive interest on idle crypto assets.

Risk Management Tools

Automated stop-loss orders, liquidation alerts, and analytics help traders minimize losses & increase capital.

Collateral System

Real-time cryptocurrency valuation and automatic margin call notifications features in the margin trading.

Interest on Borrowed Funds

Hourly market demand is the basic calculation of dynamic interest rates. It reflects fair pricing for borrowers and offers attractive yields.

Advanced Order Types

Complex strategies can execute using limit, market, stop-limit, trailing stop, OCO, and conditional orders, which all precise control.

Multi-Asset Support

Through cross-margin and isolated margin modes, hundreds of cryptocurrency pairs trade in spot and futures markets at the same time.

Robust Wallet System

The hot and cold wallet architecture offers instant deposits and rapid withdrawals. It also provides complete transparency of the transaction history.

Robust Admin Panel

The margin trading app has a dashboard for monitoring trades. And also manages users, configuring fees, generating reports, and maintaining platform health efficiently.

These powerful features transform trading potential, but understanding leverage mechanics is crucial. Next, we will decode how leverage trading actually multiplies your market opportunities.

What is Leverage Trading?

Leverage trading is a very efficient tool for a trader to increase their exposure in the market. It can be by borrowing funds from exchanges or brokers. Cryptocurrency margin trading, leverage is for investors with larger funds.

Let’s say 10x leverage, it means that the trader can open a position of $10,000 with only $1,000 as collateral. This leverage trading mechanism amplifies potential profits. And also the losses are in the same proportion. The most popular crypto exchanges provide different levels of leverage for trading. The range is from 2x as a conservative margin to 100x as an aggressive one.

Leverage magnifies the opportunities greatly, but how does it differ from margin trading? Let’s get clear on these two often misunderstood terms and their distinct characteristics.

Difference Between Margin Trading and Leverage Trading

Though the terms are often interchanged. Margin trading and leverage trading are two distinct concepts. The basic differences enable traders to choose based on their goals.

Margin Trading vs. Leverage Trading

Margin trading is a more comprehensive term that includes all assets’ purchasing by taking loans, where traders provide collateral (margin) to their accounts to receive money. The margin serves as a safety net, and the traders have to pay interest on the amount borrowed. Margin trading is all about borrowing, lending, collateral management, and interest payments. It is the very basis that makes leveraging possible. And one has to understand it before starting a margin trading exchange development.

On the other hand, leverage trading only highlights the multiplication factor. Leverage is the ratio of the investment to the broker’s money and the investor’s capital. These are expressed as 2x, 10x, 50x, or even more. It is, in fact, a part of margin trading that indicates how much market exposure you gain. With 5x leverage, you actually control five times your original investment.

The main difference is in the areas of application: While margin trading involves a complete system of collateral, borrowing methods, interest, and liquidation, it is a broader concept; leverage is just the multiplication in that system. You do margin trading to get to leverage, but leveraging is only a part. Imagine margin trading as a car; then leverage is the gas pedal. Both are necessary for the trading strategy, but they perform different roles.

Having got a grip on these concepts, it is time to reveal the real mechanism behind the scenes. How do exchanges use margin trading to actually execute trades?

How Does Crypto Margin Trading Exchange Work?

Crypto margin trading exchanges are very complex and advanced platforms. They are built on the smoothest of mechanisms connecting the three parties. It is borrowing, lending, and automated systems. There is no stop in trading execution and management through the use of leverage.

Step 1: Setting Up and Verifying Your Account

The KYC process is completed by the traders. And after that, the collateral is deposited in the margin accounts, and their preferred trading parameters and limits are set.

Step 2: Deposit of Collateral

Users can transfer cryptocurrency assets that function as their collateral. It determines their borrowing capacity and the highest leverage ratios available for trading.

Step 3: Loaning of Funds

The exchange connects borrowing requests with the available liquidity pools or lenders. Hence it involves the setting of loan terms and interest rates instantly.

Step 4: Opening of Positions

The traders make leveraged orders using the money they borrowed. With the exchange constantly calculating the margin requirements and monitoring the position’s health.

Step 5: Ongoing Surveillance

It monitors market prices, margin levels, and liquidation thresholds in real-time. The system sends out alerts when positions get too close to the critical risk zones.

Step 6: Position Closing and Settlement

Profits or losses are determined once the position is closed. You repay the borrowed amount plus interest. Then, the remaining balance is returned automatically.

It is very complicated to get a hold of the exchange’s mechanics. However, you can identify which blockchain networks are the best for margin trading platforms.

Build Margin Trading Exchanges on Leading Blockchain Networks

Building on robust blockchain networks guarantees that margin trading exchanges will provide exceptional performance, security, scalability, and smooth cross-chain trading features globally.

- Ethereum

- Binance Smart Chain (BSC)

- Solana

- Avalanche

- Optimism

- Fantom

- Tron

- Arbitrum

- Polygon

- Near Protocol

- Cosmos

- Polkadot

Picking a suitable blockchain to develop a margin trading exchange guarantees scalability and security. Then, let us understand the various trading modes with greater flexibility.

Various Margin Crypto Trading Modes in Your New Exchange

Users can choose from various trading modes based on their risk profiles. If someone prefers a conservative, isolated position, they can select that. Others might want a more aggressive cross-margin leverage and can easily opt for it.

Isolated Margin

This strategy limits the risk to particular trades by blocking funds for each trade. And prevents total account liquidation in case of price shifts that are not in favor of the trader.

Cross Margin

The risk of liquidation increases along with the efficiency of capital, which is also maximized as the entire account balance is used as collateral for all positions.

Spot-Margin Hybrid

It is a combination of regular spot trading and margin trading. It allows the trader to switch between leveraged and other positions in a single interface.

Flexible Leverage Mode

This mode provides the possibility of adjusting the leverage dynamically while the trade is still open, and thus, traders can either increase or decrease it depending on market conditions.

Automated Margin Trading

The strategies are automatically executed by AI-powered bots with user instructions. It takes care of the positions, stop-losses, and take-profits without the need for constant manual monitoring.

High-Frequency Margin Mode

The infrastructure is optimized for the algorithmic traders who can thus execute hundreds of leveraged orders per second with almost no latency or slippage.

Demo Margin Trading

Traders can practice their leveraged trading strategies with the help of virtual funds first in a risk-free, simulated environment before they invest their real money.

All these options can make a trader’s experience tailored to their needs and preferences. Let us now reveal the complete process behind the creation of your exchange.

Crypto Margin Trading Exchange Development Process

There is a meticulous execution across seven crucial phases that each lay the foundation for your competitive margin trading exchange development process to turn your vision into reality.

Market Research & Planning

We will help find the right audience, spot the missing parts in the market, and come up with your unique value proposition for winning.

Legal Compliance

Understand the different regulations, get the licenses, set up KYC/AML, and other protocols. Then learn about the legal frameworks in various regions.

Platform Architecture & Core Engine

Plan a microservices architecture that is flexible and scalable. Create the matching engine, liquidation algorithms, and develop strong APIs for smooth operations.

Wallet & Payment Integration

Get the multi-currency hot/cold wallets to link payment gateways. There are new fiat on-ramps available, safe deposit and withdrawal systems.

User Interface & Experience

Build user-friendly dashboards, create mobile apps. It makes trading workflows easier to understand. And users come back by creating engaging experiences.

Risk Management & Security

Install encryption with several layers, set up triggers for automated liquidation, restrict positions, and systematically test for vulnerabilities with penetration testing.

Testing & Launch

Carry out extensive beta testing, stress testing, collect user feedback, fix critical bugs, and plan the market launch in a strategic manner.

Therefore, your crypto margin trading exchange application is completely ready. And if customization is also needed, many services offer that. But the bigger question is how to get started with the margin trading exchange development and launch it in the digital marketplace.

Why Choose Cryptiecraft for Crypto Margin Trading Exchange Development Services?

Cryptiecraft is the topmost cryptocurrency exchange software development company, providing new trading exchange development solutions that will be in line with your business vision. Our experience in creating strong white label crypto exchange software allows fast market entry without quality and security compromise. We offer a complete range of turnkey crypto exchange solutions. This includes everything from architecture design to post-launch support. We simplify the technical challenges for you.

Our skilled developers use blockchain technology to build top-notch trading platforms. These platforms include features like multi-leverage modes, automated liquidation systems, and robust security protocols designed for institutions. We merge low-cost development, compliance with regulations, and high-capacity infrastructure to ensure your platform is ready to launch in the crypto market.

Frequently Asked Questions

Q1. What is a margin trading exchange?

Ans: A margin trading exchange is a platform that allows traders to borrow funds to increase position size, amplifying potential gains and losses while requiring collateral and risk management.

Q2. What are the main benefits of margin trading for traders?

Ans: The traders get more capital efficiency, strategies, and the freedom to move around markets. But has to understand liquidation risks and impacts from volatility.

Q3. How are the margin requirements set by the exchanges?

Ans: The margin requirements need low collateral to open and maintain positions. It helps them manage risk and protect traders during sudden price movements globally.

Q4. What are the factors that lead to liquidation in margin trading?

Ans: Liquidation is a process that happens when losses cross the limit set by the trader. This automatically closes the position, preventing more debt. It highlights the importance of stop-loss strategies in responsible trading.

Q5. What is the level of safety for margin trading exchanges?

Ans: The security features generally comprise strong custody systems. They are real-time risk engines, and compliance controls protect user funds. And globally maintain the trading environments that are fair and trusted.

Q6. What are the criteria for selecting a margin trading exchange for traders?

Ans: The process of picking the right platform through a series of evaluations is important. It can be liquidity depth, user-friendliness of the interface, fee structure, educational resources, and quality of support that are in line with the individual’s trading goals and risk tolerance.

.