What do weather forecasts, Oscar winners, and Bitcoin’s next price surge have in common?

They’re all shaped by the wisdom of crows, a phenomenon where collective predictions win individual expertise.

This collective intelligence phenomenon now powers Blockchain prediction platforms worth billions. It is a marketplace where your conviction about crypto market prediction gives you a position to stake, trade, and profit from. The prediction market platform isn’t just about forecasting; it’s about creating liquid markets where information becomes currency. The CEX prediction markets and DEX prediction market mechanics remain fascinating. A prediction market platform enables users to trade event-based contracts where market prices indicate outcome probabilities. It is all about forecasting with financial consequences that demand accuracy.

This blog unpacks everything one needs to know to start a crypto prediction market platform development and the blueprint behind building a platform that actually works.

What is a Crypto Prediction Market Platform?

Crypto prediction market platform is a blockchain-based decentralized ecosystem where participants trade event-outcome contracts using cryptocurrency, with market prices reflecting collective probability forecasts. These prediction platforms use smart contracts to enable trustless, transparent wagering on real-world events from elections to price movements, where accurate predictions yield financial rewards.

They function as CEX prediction markets or DEX prediction markets, allowing real-time crypto market prediction based on collective intelligence. It eliminates any intermediaries and enables trustworthy, verifiable, and fair outcome resolution on Blockchain networks.

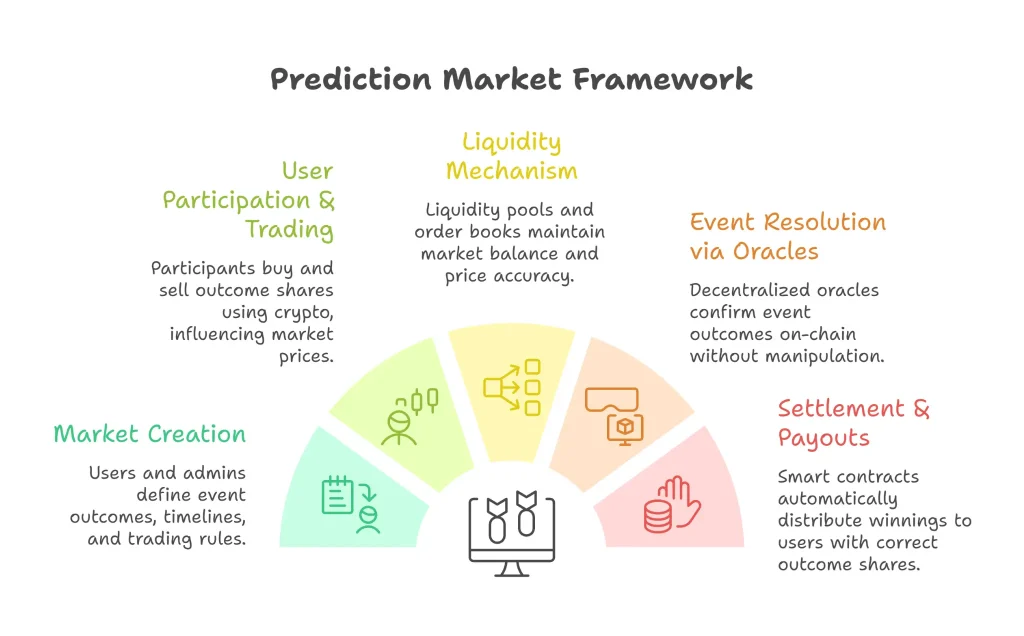

How Does a Prediction Market Platform Work?

The prediction market platform functions through its ability to let users establish prediction markets while trading outcome-based contracts and using its blockchain system to provide users with transparent pricing, equitable settlement processes, and exact event outcomes.

Market Creation

Prediction markets are created for specific events by users or admins who define the outcomes, timelines, and trading rules, and cryptocurrencies in the prediction market platform.

User Participation & Trading

Participants buy or sell outcome shares using crypto, which they use to make predictions about outcomes, while their trading activities cause price changes in the market.

Liquidity Mechanism

Liquidity pools and order books operate together to maintain market balance, which enables prices to reflect both current market trends and estimated probabilities of events.

Event Resolution via Oracles

Decentralized or trusted oracles fetch real-world data and confirm event outcomes on-chain without manipulation or centralized interference.

Settlement & Payouts

The prediction platform uses smart contracts to automatically distribute winnings to users who hold correct outcome shares after the event result has been confirmed.

Prediction market platforms use their three components of trading systems, liquidity models, and oracle-based resolution methods to create open forecasting systems that provide rewards for accurate predictions and collective intelligence.

Centralized vs Decentralized Crypto Prediction Market Models

Centralized and decentralized crypto prediction market models differ in control, transparency, and architecture, shaping how CEX vs DEX prediction markets enable decentralized forecasting and user participation.

| Feature | CEX Prediction Markets | DEX Prediction Markets |

| Control & Governance | Centrally managed by a single authority | Governed by smart contracts |

| Transparency | Limited public operational visibility | Fully on-chain transparent operations |

| Fund Custody | Platform control user assets | User retains full custody |

| Compliance | Strict regulatory and KYC rules | Minimal or no compliance |

| Scalability | High-performance centralized systems | Dependent on blockchain scalability |

| Security Model | Relies on internal security systems | Secure by Blockchain consensus |

| Customization | Easy centralized feature modifications | Governance-based protocol changes |

Selecting between CEX vs DEX prediction markets depends on business goals, regulatory strategy, and user preferences, with decentralized forecasting offering greater transparency and autonomy.

Key Components of a Crypto Prediction Market Platform

The essential elements of a crypto prediction market platform function together to establish markets, handle trading activities, maintain unbiased results, and provide users with automated forecasting tools that operate transparently.

Market Creation Engine

The market creation engine allows admins or users to create prediction markets by defining event details, outcomes, timelines, and trading rules easily.

Smart Contracts

Smart contracts automatically manage trades, lock funds, enforce rules, and execute settlements without manual intervention or third-party involvement.

Liquidity Mechanism

The liquidity mechanism ensures enough buyers and sellers by using pools or order books to enable smooth trading and accurate price discovery.

Decentralized Oracles

It securely fetches real-world event data and submits verified outcomes to the blockchain for fair and trusted market resolution.

User Wallet System

This system enables participants to store, send, receive, and trade cryptocurrencies securely within the prediction market platform.

The integration of essential components enables a crypto prediction market platform to operate markets with reliable performance while executing transparent settlement processes and providing users with seamless access to blockchain-based services.

Core Features of a Prediction Market Platform Development

The fundamental elements determine how users manage their outcome trades, price discovery processes, and verify their settlement, establish the operational framework for blockchain prediction platforms, and crypto prediction market platforms.

Market Creation & Management

This feature allows admins to create and manage prediction markets, which they can pause or close according to defined outcomes, timelines, and market rules.

Real-Time Odds & Pricing Engine

The pricing engine continuously updates odds based on trading activity, liquidity, and demand to reflect accurate market probabilities.

User Trading Interface

The user trading interface provides a simple dashboard that enables users to place trades and view odds, track positions, and manage predictions.

Liquidity Pool Integration

Liquidity pool integration ensures sufficient funds are available for trading, which enables smooth order execution and reliable price discovery.

Automated Market Settlement

Automated market settlement uses smart contracts to finalize results and distribute payouts instantly after verified outcomes.

The combination of these features establishes a scalable prediction market platform to receive fair trading results, continuous market insights, and automatic settlement processes for current crypto prediction market platforms.

Security Features of Crypto Prediction Market Platform

The crypto prediction market platform development requires robust security measures that protect user assets, maintain data integrity, and safeguard trading operations while establishing trust between blockchain prediction platforms and crypto prediction market platforms.

Smart Contract Auditing

It evaluates code in detail to identify security weaknesses while verifying that contracts operate according to their designed specifications without any unidentified security threats.

Secure Wallet Integration

The platform enables users to link their secure wallets, which protect their private keys and allow them to conduct transactions securely within the system.

Oracle Data Validation

The process of Oracle data validation checks multiple data sources to verify that event outcomes are both accurate and resistant to any attempts at data alteration.

Transaction Monitoring

The DEX prediction platform establishes ongoing monitoring of both on-chain and platform activities to detect any suspicious activities, which helps in stopping fraudulent operations.

Access Control Management

This establishes user roles together with their respective access rights to restrict users from accessing protected system functions and administrative tasks.

Advanced security measures from a trustworthy crypto prediction market platform development company supports in building trust and minimizing operational risks while creating decentralized forecasting systems that ensure business success.

Add-On Features of our Prediction Market Platform Development

The prediction market platform development process receives advancement through add-on features, which transform blockchain prediction platforms into interactive systems that maintain user loyalty while expanding their user base for crypto prediction market platforms.

Multi-Blockchain Support

The multi-blockchain support enables crypto prediction market platforms to operate on multiple networks. It decreases transaction costs, improves performance, and gives increased access.

AI-Powered Market Insights

The AI-powered market insights enable users to study market trends together with probability data to give precise market predictions and advanced data-based methods.

Social Trading

It lets users track expert traders while they duplicate their methods and work together, which boosts user participation in decentralized forecasting networks.

Gamification Mechanics

The gamification mechanics enable platforms to provide users with rewards and challenges along with leaderboard access. This leads to higher user engagement & fun to use.

Advanced Analytics Dashboard

The advanced analytics dashboard offers complete visibility into their operational performance, together with their user base and financial performance indicators.

The decentralized prediction market platform with these add-ons can deliver smart features while providing excellent user experiences that compete effectively in the crypto prediction market.

Blockchain & Tech Stack Used in Prediction Market Platform Development

The prediction market platform development depends on distributed ledger networks and current technology stacks, which determine their ability to grow, handle transactions, protect data, and connect with other decentralized forecasting systems.

- Ethereum Blockchain

- Binance Smart Chain

- Polygon network

- Solana Blockchain

- Avalanche Network

- Layer 2 Scaling Solutions

- Smart Contract Frameworks

- Decentralized Oracle Networks

- Cloud Infrastructure Services

- Web Front-End Technologies

The selection of an appropriate blockchain & technology stack serves as the critical foundation. It makes the platform successful with secure transaction capabilities and expanding system capacity to handle rising user demand.

Role of AI & Advanced Analytics in Crypto Prediction Platforms

The blockchain prediction platforms use AI and advanced analytics to process extensive data, which uncovers trading patterns that human traders are unable to detect. The machine learning algorithms use historical results together with sentiment information and on-chain data to improve their ability to predict cryptocurrency market movements. The research demonstrates that AI-based prediction systems can accurately forecast cryptocurrency price changes with an accuracy rate of 85%, whereas platforms that use predictive analytics achieve 40% more user interaction.

The leading companies that create crypto prediction market platforms now use neural networks together with natural language processing and real-time data collection to power both centralized and decentralized exchanges, which establishes intelligent systems that use algorithmic analysis together with crowd intelligence to achieve better forecasting results.

Monetization Models for Prediction Market Platforms

Prediction market platforms use monetization models for revenue generation through two methods, which create user value and provide liquidity incentives and support their platform expansion.

- Trading commission fees

- Liquidity provider rewards marking

- Features market listings

- Market creation fees

- Premium user subscriptions

- Withdrawal and transaction fees

- API access charges

- Data analytics monetization

- White-label licensing fees

- Advertising and sponsorships

Prediction market platforms can make continuous income, customer loyalty, and enduring ecosystem success through their implementation of multiple monetization methods derived from decentralized exchange development.

Regulatory & Compliance Requirements for Prediction Market Platforms

Regulatory and compliance requirements ensure crypto prediction market platforms operate legally, protect users, and meet global standards across crypto prediction market platforms.

KYC and User Identity Verification

KYC verification establishes user identities, which enables platforms to prevent fraud and meet regulatory requirements while building participant trust.

AML and Transaction Monitoring

The system conducts continuous transaction monitoring to identify suspicious activities and detect potential money laundering operations and unauthorized financial transactions.

Jurisdiction-Based Licensing

The platform establishes legal operational status through jurisdiction-based licensing, which requires compliance with specific crypto, gaming, and financial regulations in each country.

Securities and Derivatives Compliance

This compliance framework ensures that prediction contracts adhere to securities and derivatives regulations, which govern financial markets.

Data Privacy and User Protection

Data privacy measures safeguard user information through encryption and access controls while following international data protection regulations.

Meeting regulatory requirements strengthens platform credibility, reduces legal risks, and enables crypto prediction market platforms to scale safely across global Blockchain ecosystems.

Real-World Use Cases of Prediction Market Platforms

Prediction market platforms use collective intelligence and data-driven insights together with decentralized models to provide accurate outcome predictions that help with decision-making across different industries.

- Financial market forecasting

- Cryptocurrency price prediction

- Sports and esports outcomes

- Economic indicator predictions

- Entertainment and awards prediction

- Political and election forecasting

- Corporate decision forecasting

- Governance and DAO voting insights

- Weather and climate forecasting

- Risk assessment and hedging

These use cases show how prediction market platforms deliver practical forecasting value across diverse sectors and real-world scenarios.

Top Crypto Prediction Market Platforms

Top cryptocurrency prediction market platforms demonstrate how their blockchain-based forecasting systems achieve accurate decentralized predictions through their operational model. It includes user participation and transparent market conditions and liquidity.

- Polymarket

- Kalshi

- Limitless

- Myriad

- Augur

- Polkamarkets

Businesses acquire knowledge about effective prediction market implementation through their analysis of top cryptocurrency prediction market platforms.

Step-by-Step Process to Build a Crypto Prediction Market Platform

The crypto prediction market platform development process combines business goals with blockchain technology to create an accurate and transparent system that enables users to trade efficiently.

Market Use Case Definition

One has to identify prediction goals, target users, supported events, and monetization strategy to shape the platform’s core purpose.

Blockchain and Architecture Design

Developers select appropriate blockchain networks while creating a system architecture that provides both scalability and effective transaction processing.

Smart Contract Development

Smart contracts create automated trading systems to secure funds and manage outcome settlements without requiring human intervention.

Oracle Integration

Oracles deliver verified real-world data to smart contracts to get prediction results that remain accurate and secure against unauthorized changes.

Security Testing and Auditing

This phase conducts system vulnerability assessments while testing smart contracts and infrastructure against established security requirements.

Platform Launch

The final step releases the platform publicly, activates user access, and continuously monitors performance for stability and growth.

Manually following this structured approach enables businesses to create reliable and transparent crypto prediction market platforms.

Why Choose Us as Your Prediction Market Platform Development Partner?

Choosing Cryptiecraft as your prediction market platform development partner is one of the best choices because our team has a good understanding of both Blockchain technology and real market dynamics. We help shape your idea, validate use cases, and choose the right Blockchain architecture for long-term success. Our crypto prediction market development services cover everything from custom development and security auditing to launch support and post-deployment optimization. We have hands-on experience in developing a crypto prediction platform. We follow a consultative approach, transparent communication, and commitment to supporting your prediction platform as it evolves in a fast-changing Blockchain ecosystem.

Frequently Asked Questions

Q1. What is a prediction market platform?

Ans: A Prediction market platform is an online marketplace where event outcomes are traded as positions, allowing crowd sentiment to determine the likelihood of future results.

Q2. How much does it cost to develop a crypto prediction market platform?

Ans: The overall investments in crypto prediction market platform development depend on technical scope, Blockchain infrastructure, customization needs, compliance efforts, and long-term maintenance plans.

Q3. What is the difference between centralized and decentralized prediction markets?

Ans: A centralized platform manages trades and settlements internally, while decentralized models rely on Blockchain logic that removes direct operator control.

Q4. Which blockchain networks are best for building a prediction market platform development?

Ans: Ethereum, Polygon, Binance Smart Chain, Solana, and Avalanche are considered some of the ideal Blockchain networks for building prediction market platforms due to their scalability, smart contract opportunities, and active ecosystems.

Q5. Can prediction markets be considered legal and regulated?

Ans: The prediction markets regulatory acceptance depends on how markets are structured and whether platforms follow jurisdiction-specific financial and compliance frameworks.

Q6. How long does it take to develop a prediction market platform?

Ans: The project timeline depends on design complexity, security standards, integration depth, and testing requirements before public release.

Q7. Can prediction market platforms support multi‑chain ecosystems?

Ans: Yes, prediction market platforms can be architected to connect multiple blockchains, improving accessibility, flexibility, and network resilience.

Q8. How does AI improve forecasting accuracy in prediction markets?

Ans: AI refines predictions by processing large datasets, recognizing trends, and assisting users with clearer probability insights.

Q9. Can prediction markets be used for sports and esports predictions?

Ans: Prediction markets are commonly applied to sports and esports, allowing users to trade outcomes based on performance expectations.

Q10. Can non‑crypto users participate in blockchain prediction markets?

Ans: User-friendly design and integrated payment methods make it possible for on-crypto audiences to participate without technical barriers.