If you are a startup or an experienced enterprise that is looking to enter into the crypto world, but wondering about the crypto token development cost? Then you are at the right place. It’s a frequent question among beginner companies and entrepreneurs who consider creating their own crypto tokens. If you are indeed the one who is in that category, then don’t panic, we will reveal to you the price of a token.

The reason is that creating a cryptocurrency token has quickly transformed into a breakthrough concept, particularly for the inexperienced. Eventually, the startups will have a very limited budget for the development of crypto tokens. Thus, knowing the cost of different expenses would be very useful information for you.

In this blog, we not only have a cost breakdown but also point out the major factors that affect the price of a crypto token creation.

What is a Crypto Token Development?

Crypto token development is the process of creating blockchain-based digital tokens that represent assets, utilities, or rights using smart contracts on decentralized networks.

To develop a crypto token, one has to go through the user specification, creation, and deployment of a new digital token on the blockchain infrastructure of one’s choice, such as Ethereum, BNB Chain, or Solana, using smart contracts. These can be used as utility tokens representing various features like governance rights, rewards, or access within the corresponding decentralized ecosystems.

The methodology involves setting the standards for tokens, their supply model, and security measures, as well as the legal aspects of the matter. Additionally, the developers have to make sure that the tokens are connected to wallets, exchanges, and dApps so that there will be a smooth and liquid flow of the tokens. The cryptocurrency token development can be a way for companies to promote their projects, raise funds, and offer automations while being open and transparent in their dealings. It allows businesses and startups to quickly and efficiently get decentralized solutions that capitalize on the immutability, security, and global accessibility of the blockchain.

Average Cost to Create a Crypto Token

The average cost of creating a crypto token is influenced by a number of factors, where the most important one is the blockchain selection, followed by the standard of the tokens, the complexity of the smart contract, and the security requirements. In the case of simple utility token development, there is less resource requirement as compared to that in the case of advanced crypto token creation, which involves governance features, staking mechanisms, and compliance that require a higher investment.

Other factors affecting the cost include smart contract auditing, compatibility with wallets, being ready for exchanges, and post-launch support. Customization, scalability planning, and regulatory considerations also play a role in the overall crypto token development expenses. Hiring a competent blockchain development company will not only streamline development efforts but also minimize the risks and provide a token solution that is secure, scalable, and ready for the market.

Crypto Token Development Cost Breakdown by Token Type

We will understand the token types breakdown, which is one of the fundamental steps for businesses that want to spend their crypto token development wisely.

Utility Tokens

Utility tokens are cost-effective, having applications in platform access, payments, rewards, and simple smart contract functionality.

Governance Tokens

This type of token gets involved by implementing a voting system, proposals, community engagement, and overall decentralized decision-making.

DeFi Tokens

DeFi tokens are characterized by a high degree of complexity since they are associated with staking, yield farming, liquidity pools, and elaborate financial smart contracts.

Security Tokens (STOs)

These types of security tokens entail legal compliance-centric development, integration with law, verification of identity, and creation of frameworks for the representation of regulated assets.

NFT & Ecosystem Tokens

NFT and ecosystem tokens cover such requirements as the handling of metadata, integration with the marketplace, implementation of royalty logic, and interoperable ecosystems.

Hence, these token types’ evaluation in advance leads to accurate budgeting, smooth development, better compliance alignment, and big token ecosystems, all of which are the foundations of the blockchain’s sustainable business growth.

Also Read>>> Type of Crypto Tokens

Detailed Cost Components to Develop a Crypto Token

Crypto token development is a costly process that goes through several stages, such as planning, development, deployment, security, and growth-related expenses, and the detailed cost components make it easy to understand where investment is allocated and thus help businesses to plan strategically.

Tokenomics Design

The costs associated with the tokenomics design are the result of research, supply modeling, incentive structures, utility planning, and sustainability assessments.

Smart Contract Development

Smart contract development costs are determined by the token’s complexity, the choice of blockchain, the customizations, and the work involved in the implementation of features.

Security Audit & Testing

A security audit and testing process incurs costs related to vulnerability assessments, code reviews, penetration testing, and the overall risk mitigation measures.

Wallet & Platform Integration

The costs of wallet and platform integration include setting up compatibility, making API connections, optimizing the user experience, and readiness of the exchange.

Deployment & Gas Fees

Deployment and gas fees cover the costs associated with the execution of the blockchain, contract deployment, and requirements for network validation.

Marketing, Listing & Community Costs

The costs of marketing, listing, and community development are mainly incurred by branding, outreach to exchanges, building a community, and engaging investors.

Therefore, grasping these cost areas will enable businesses to budget wisely, thus reducing risks and making successful crypto token launches possible.

Understanding the Cost Variations by Blockchain Platform

The different blockchain platforms applied in the development of crypto tokens result in differences in token development costs, scalability, transaction efficiency, and sustainability of operations in the long run for companies that introduce tokens based on blockchain technology.

Ethereum

The development of the Ethereum ERC-20 token may be high due to the congestion of the network, complicated smart contracts, and the requirement for top-notch security.

BNB Smart Chain

Token development on the BNB Smart Chain gives the advantage of a cost-efficient deployment, faster transactions, and compatibility with wallets and exchanges.

Polygon Tokens

Developing a token on Polygon incorporates a lower overall cost due to the provision of scalable infrastructure, very low transaction fees, and the use of Ethereum-compatible smart contracts.

Solana & Other Low-Fee Chains

Token development on Solana and other low-fee blockchains entails the reduction of costs through the use of high throughput, quick confirmations, and effective consensus mechanisms.

The selection of the most suitable blockchain platform not only reduces the costs associated with crypto token development but also guarantees performance, scalability, and the growth of the ecosystem in the long run.

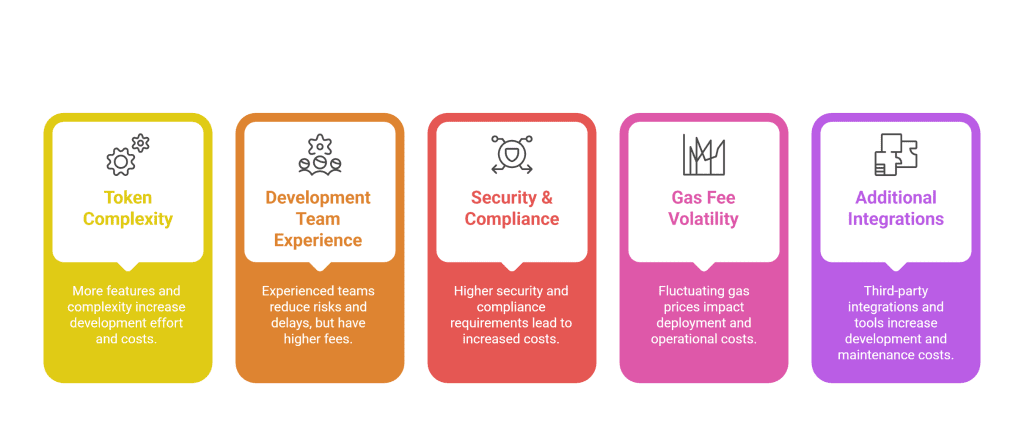

Key Factors Affecting Crypto Token Development Cost

These are some of the key factors that dictate the cost of crypto token development; therefore, they help the investor to be aware of and consider the different pricing, technical measures, and strategies for creating secure and efficient blockchain token solutions.

Token Complexity & Features

The more complex the token and the more features it has, the more demanding the crypto token development process becomes in terms of effort, testing, and costs.

Development Team Experience

While the fees of experienced blockchain developers are higher, they cut the risks, reworks, delays, and security problems.

Security & Compliance Requirements

Costs become high with increased security, and compliance is achieved through the use of audits, legal reports, and constant monitoring.

Gas Fee Volatility

The steady change in gas prices directly affects how much money is needed for deployment, processing, and for the entire blockchain to operate.

Additional Integrations & Tools

Additional integrations of third parties, along with state-of-the-art tools, push up costs through more development, licensing, and maintenance.

The early evaluation of these factors empowers businesses to precisely estimate their budgets, thus avoiding hidden costs and ensuring the success of crypto token development.

Crypto Token Development Timeline & Cost Correlation

Development timeline and cost correlation impact the expenditures related to the crypto token development, the allocation of resources, the speed of delivery, and the overall project efficiency in a direct way.

- The costs for the project are increased by shorter development timelines, which require intensive resource allocation and accelerated development.

- The longer timelines lower the immediate costs but may raise the total expenses through the extended resource usage.

- The development of complex token features takes longer, thus increasing the costs due to the need for more testing and revisions to be done.

- Non-compliance or audits may cause the project to take longer than planned, which in turn affects the budgeting of the whole crypto token development.

Hence, planning and scheduling development timelines in a balanced way guarantees the project is cost-efficient, quality is delivered, and has successful long-term outcomes in the crypto token market.

DIY-Template & No-Code Token Creation Costs

The costs of the DIY template and no-code token creation vary depending on the technical control, customization, and scalability requirements for the long run. While DIY crypto token development seems affordable at first, it actually requires strong blockchain expertise, extensive testing, and higher maintenance effort.

Development effort is lower for template-based tokens, but it is accompanied by faster deployment, though flexibility and advanced features are still not available. No-code token creation platforms are easier for non-technical users but often come with platform dependency, limited customization, and service fees. Choosing the right approach significantly affects the overall crypto token development costs, security, ownership control, and future expansion potential.

Smart Contract Audit Cost and Importance

The cost of smart contract audit and its importance are decisive factors in the secure development of crypto tokens and the success of blockchain applications. A smart contract audit conducted by a professional examines the quality of the code, the correctness of the logic, and the risks of vulnerability before the contract is deployed. The cost of audits depends on the complexity of the contract, the blockchain platform, the level of security required, and so forth, but the whole investment cuts down the risks from exploitation significantly.

The contracts that have been audited create the trust of investors, get ready for regulation, and increase the trustworthiness of the platform. Regular audits also facilitate scalability, eliminate pricey defeats, and guarantee reliability for the long haul. Giving priority to smart contract auditing not only enhances security but also guarantees the protection of digital assets and the existence of safe, compliant, and trusted blockchain systems.

Hidden & Additional Costs to Consider

One has to consider the hidden and additional costs to consider that have an influence on the overall crypto token development budgets that impact the compliance readiness, market entry speed, and the long-term sustainability of the platform.

Legal & Regulatory Fees

The legal and regulatory fees take care of the compliance reviews, the documentation, the licensing, and the advisory services that are specific to the respective jurisdictions.

Exchange Listing Fees

The exchange listing fees take into account the due diligence, the technical integration, the marketing requirements, and the liquidity support arrangements.

Ongoing Maintenance & Upgrades

Ongoing maintenance and upgrades refer to bug fixes, performance optimization, security updates, and feature enhancements.

Overall, considering these hidden costs leads to proper budgeting, easier token launches, and just the same successful days ahead in the already tough crypto markets.

Regional Cost Differences to Develop a Token

Worldwide crypto token development budgets are heavily impacted by the differences in regional costs. North American development teams expect hefty payments due to the depth of their expertise. European blockchain developers are able to balance their competitive pricing with extensive knowledge of the regulations.

Asian regions are generally considered to be the most economical while still providing good quality. Teams from Eastern Europe possess both the necessary skills and the ability to work at lower rates. Regional regulations play a role in the legal costs as well as in the amount spent on compliance. Different time zones might lead to communication being less effective and the project taking longer than expected.

Changes in currency value influence the choice of outsourcing and also the expenses for long-term development. The presence of local talent is a major factor affecting the flexibility of hiring and scalability of the project. The selection of the most appropriate area is a way of maximizing the two benefits: cost efficiency and good delivery.

Crypto Token Development Cost Comparison Table

Here, let us compare crypto token development costs between various token types, blockchains, and complexities. It is a tool for businesses to weigh up different options, budget efficiently, and pick the right method for token development.

| Token type | Development complexity | Security requirements | Customization level | Compliance impact | Overall cost trend |

| Utility token | Low to moderate complexity | Basic security measures | Limited customization | Minimal compliance needs | Cost efficient |

| Governance token | Moderate complexity | Enhanced security layers | Medium customization | Community governance consideration | Moderate cost |

| DeFi tokens | High technical complexity | Advanced security & audits | High customization | Protocol compliance requirements | Higher cost |

| Security tokens | High regulatory complexity | Enterprise-grade security | Limited flexibility | Strong legal compliance | Premium cost |

| NFT & Ecosystem tokens | Variable complexity | Standard to advanced security | High creative flexibility | Minimal regulatory impact | Variable cost |

| DIY/No code tokens | Low complexity | Limited security assurance | Minimal customization | Platform-dependent compliance | Lower initial cost |

| Custom development | High complexity | Full-scale security audits | Complete customization | Flexible compliance handling | Higher long-term value |

Knowing these cost differences enables businesses to make prudent investments, lower risks, and pick token development strategies that are in line with their long-term blockchain goals.

Why Choose Cryptiecraft for Affordable & Secure Crypto Token Development?

Cryptiecraft provides a low-cost crypto token development service while maintaining enterprise-level blockchain security. We are an experienced cryptocurrency exchange development company, and we create safe smart contracts, scalable tokenomics, and blockchain solutions that meet regulations. Our development process guarantees quicker delivery, minimized risk, and prolonged scalability. End-to-end crypto exchange integration is offered to both startups and large enterprises. Our pricing is transparent, audits are proactive, and post-launch support is there to increase project value.

Frequently Asked Questions (FAQ)

Q1. What is the average cost to create a crypto token?

Ans: The average cost of a crypto token creation depends on many factors, such as its complexity, the chosen blockchain, security, the amount of customization, compliance, auditing, and integrations.

Q2. Which factors affect the cost of crypto token development?

Ans: In general, the crypto token development cost is determined by the type of token, the blockchain network, the scope of features, the method of development, the security audit, the compliance with regulations, the depth of testing, the strategy of deployment, and the maintenance.

Q3. How much does a smart contract audit cost for a crypto token?

Ans: The smart contract audit cost is determined by factors such as the complexity of the contract, the length of the code, the risk involved, the auditor’s skill level, the testing method applied, and other project’s urgency requirements.

Q4. Can I create a crypto token using no-code tools, and how much will it cost?

Ans: Yes, there is a possibility to create crypto tokens using no-code tools, but at a lower cost. However, often, the token’s customization, scalability, security control, and long-term flexibility would be limited.

Q5. Do the blockchain platforms (Ethereum, BNB, Polygon, Solana) affect development cost?

Ans: Development cost is greatly influenced by blockchain platforms through transaction fees, the maturity level of tooling, the amount of ecosystem support, and the security features provided, as well as the developer’s availability for optimization or integration efforts.

Q6. How long does it take to develop and launch a crypto token?

Ans: The time spent developing and launching a crypto token relies on the universality, level of customization, testing, auditing, and approval processes, and varies from rapid deployments of far simpler projects to prolonged timelines of more complex ones.

Q7. Can token development costs vary by region or country?

Ans: Token development costs differ from one region to another because of different factors, such as developer rates, regulatory situations, operational expenses, local market competition, and economic conditions affecting talent availability and infrastructure maturity.