Ever wondered why some crypto tokens let you make payments, stake, or vote, while others don’t?

That’s not a bug in the blockchain world.

In fact, the crypto ecosystem has a wide range of crypto tokens, but it’s broadly divided into two major types. While these might look the same, they serve entirely different purposes, raising debates on which is the best.

According to recent blockchain market insights, over 60% of new blockchain projects today rely on utility tokens for user interaction. While the security tokens are gaining momentum as the go-to model for regulated digital assets. Both sound like “just another crypto token,” but the truth isn’t. These two crypto tokens have completely different intents, functions, and compliance.

In this article, we’ll explore everything from what Utility and Security Tokens are to how they differ in use cases, regulations, and ownership rights. By the end of this blog, you will understand which one suits your business goal the best. Let’s begin with

What is a Utility Token?

A utility token is the type of cryptocurrency token that grants access to specific products, services, or features offered by a platform. Unlike other traditional currencies, the utility tokens are not designed for direct investment purposes. Instead, these utility tokens are designed to support the internal economy of a blockchain project.

For example, holding a utility token might let you access premium features, pay instead of transaction fee, or let you participate in making governance decisions. These utility tokens are behind the factor that supports the exchange platforms.

What is a Security Token?

A Security Token is a type of crypto token that represents the ownership or stake in an external tradeable asset. This is like the company shares, real estate, or bonds, but in a digital, blockchain-based format. These tokens are sometimes issued through Security Token Offerings, which are fully regulated under certain securities laws.

In simple terms, they are like the traditional investments we make, but operate entirely on a blockchain ecosystem. They are capable of providing investors with rights such as dividends, profit shares, or voting rights in the company.

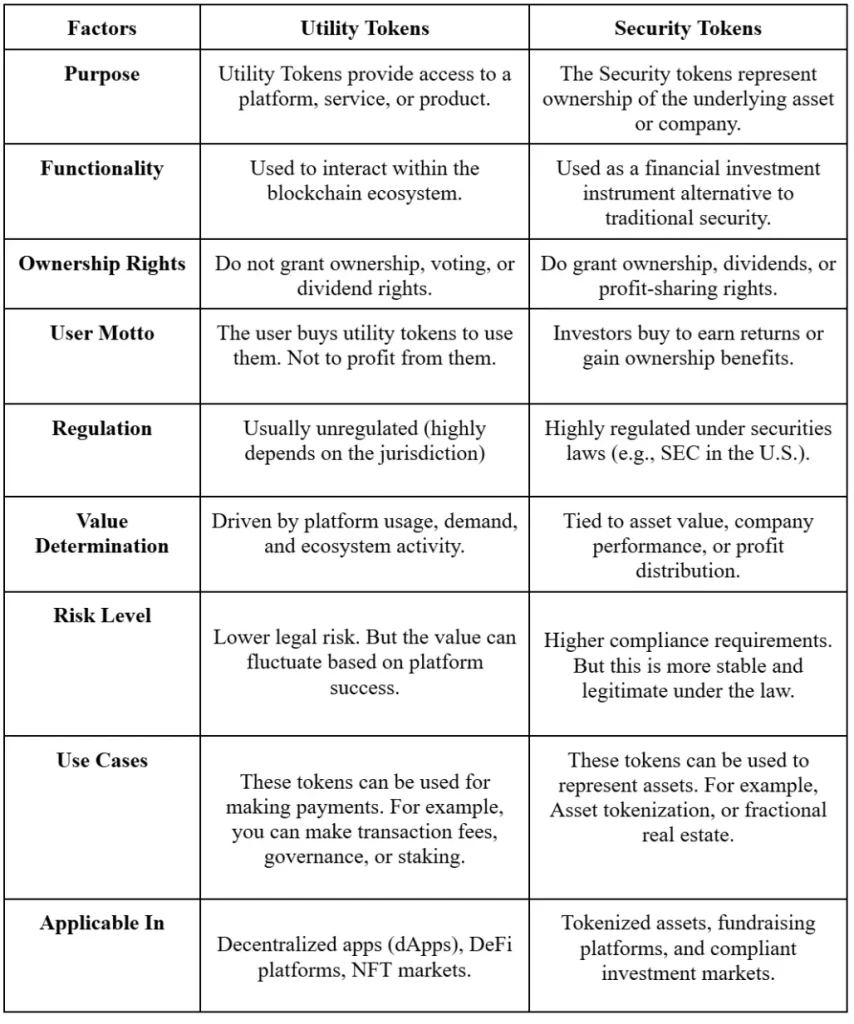

Difference Between Utility and Security Token – A Comparative Analysis

The above analysis clearly shows that while both Utility Tokens and Security Tokens are essential parts of the crypto ecosystem, they serve completely different purposes. The utility tokens drive engagement and usage within blockchain platforms. On the other hand, the security tokens connect the traditional finance and blockchain by representing real-world assets with regulatory backup.

In short, if the utility tokens support users to use and participate in the blockchain ecosystem, the security tokens empower investors to own and profit from tokenized assets. Both of these hold immense potential, but their impact highly depends on the user’s intent.

Real-World Use Cases & Examples of Utility & Security Tokens

Now that we’ve understood what these tokens are, let’s analyse in detail how they actually function in the real world. Both Utility Tokens and Security Tokens had their own niche in the blockchain space.

Examples of Utility Tokens

Just like the name suggests, the utility tokens are the driving factor of an ecosystem. They let users access, transact, and participate within the blockchain ecosystem. These tokens are designed to provide functionality rather than ownership. Some of those examples are,

- BNB

- ETH

- UNI

- SAND

- AXS (Axie Infinity)

Real-world Use Cases of Utility Tokens

- Can be used to pay for transactions and network fees

- Allows you to stake for network security or rewards.

- Participate in governance votes and ecosystem development

- Accessing exclusive platform features or products.

A Utility Token Development will enable futuristic businesses and blockchain projects to give value to their users and communities.

Examples of Security Tokens

Unlike the utility tokens, these security tokens represent a real-world value. They are often linked to ownership rights in a company, property, or seen as a financial instrument. This gives investors a digital hold on tangible assets. Some of those examples are,

- tZERO

- SPiCE

- Props

- Vevue

- BCAP

Real-World Use Cases of Security Tokens

- Can be used to tokenize real estate and offer it as a fractional ownership

- These tokens can be digitized as company equity or bonds

- Enables compliant fundraising through STOs, also known as Security Token Offerings

- Distributing dividends or revenue shares to investors via blockchain

This might have cleared that the Security tokens are combining the traditional and DeFi ecosystem, creating a more regulated investment space. On the contrary, the utility tokens are used by the users of the blockchain-based ecosystem.

Utility Token Vs Security Token – Which is the Best?

Now comes the most important question: “Which is the best crypto token, utility, or security token?”.

Well, the answer to this wouldn’t come to a single term, because both tokens are built for completely different purposes. The answer isn’t really about which one wins, but which one fits your business goal.

The Utility Tokens are the best option when it comes to creating engagement and usability within a blockchain ecosystem. They are perfect for startups and decentralized projects that want to encourage user participation, increase transactions, and build an internal economy. If your plan is to build a perfect blockchain-based product, then utility tokens are your go-to choice.

On the other hand, the Security Tokens take the entire traditional investment and place it on the blockchain. They’re all about ownership, compliance, and credibility. Backed by real-world assets and regulated under securities laws, they are ideal for businesses or investors looking for long-term stability.

In short,

- Go for Utility Token Development if your goal is to create utility, accessibility, and community engagement within your platform.

Or else,

- Go for Security Token Development if your goal is to tokenize real-world assets, ensure compliance, and attract institutional-grade investors.

Challenges and Fixing Measures of Utility and Security Tokens

Even while coming with all these benefits and characteristics, both the utility and security tokens have their own share of challenges. Here is a list of some of them,

Regulatory Uncertainty

Different countries define, regulate, and handle tokens differently. The crypto laws and regulations might differ from country to country, making the global token launches confusing and risky.

How to Overcome: Staying updated with regional frameworks like the EU’s MiCA, FINMA guidelines, and other SEC regulatory frameworks will be helpful.

Compliance Complexity

The tokens must follow heavy regulations like KYC, AML, and investor complexity. Correctly managing these laws and regulations can be helpful.

How to Overcome: Automate the compliance requirements with smart contracts that handle KYC/AML checks, investor caps, and transaction limits.

Market Adoption

The utility tokens often struggle to find proper real-world use cases, while security tokens face limited liquidity because only a few exchanges list them. This might reduce the investor interest.

How to Overcome: The utility tokens must find a proper real-world use case to serve, while the security tokens should aim for regulated or niche-focused security tokens.

Market Valuation Challenges

Both the crypto token types face unpredictable price movements. The utility token prices depend on platform demand, while security token prices follow asset performance.

How to Overcome: Introduce stabilizing mechanisms like staking, token burns, or reserve systems, providing a clear valuation model and project updates.

Investor Perception

The utility tokens are often seen as speculative, while security tokens are viewed as too rigid or corporate. This gap might limit community engagement and funding opportunities.

How to Overcome: Building investor awareness campaigns around your tokens might help educate your niche audience about your token’s real value and potential use cases.

Why Choosing Cryptiecraft As Your Crypto Token Development Company is the Smartest Choice?

Cryptiecraft is a reputable Crypto Token Development Company, known for delivering reliable crypto token development services. Cryptiecraft has a specialized team of experts, blockchain professionals, and business analysts who will work together to bring your token ideas to life. What sets us apart is our end-to-end development approach we follow. From initial planning ideation to auditing, the team handles everything completely and carefully. Whether you’re planning to launch a Utility Token, Security Token, or even explore other tokenization options, Cryptiecraft stands as the best fit.

So, ready to begin your Tokenization Journey?

Frequently Asked Questions (FAQs)

Q1: What is the main difference between a utility token and a security token?

Ans: The main difference between the utility and security tokens is the purpose and regulation. The utility tokens give holders access to a product or service within a blockchain ecosystem. On the other hand, the security tokens represent ownership or investment rights.

Q2: Can a token be both a utility token and a security token?

Technically Yes, it is possible. But it depends on how the token is structured and promoted. If a token offers platform utility and is capable of giving profits from regulators, then it might also be classified as a security token.

Q3: Are utility tokens legal in all countries?

Ans: No. Some countries allow utility tokens, while others are quite sensitive to them. Besides, the legality depends on how the utility tokens behave as an investment or is used in the ecosystem.

Q4: How can startups decide whether to issue a utility or a security token?

Ans: Considering your business requirements, you can make that decision easily. If you aim to enhance ecosystem participation, then Utility tokens are the choice. But if you aim to raise or share profits and funds, then security tokens are the best choice.

Q5: What role do smart contracts play in token issuance?

Ans: Smart contracts play a significant role. They help in automating tasks like token minting, transfers, and other compliance rules.

Q6: Are NFTs considered utility or security tokens?

Ans: Mostly. The NFTs are utility tokens, since they represent ownership of a unique digital asset like art, collectibles, or in-game items.

Q7: What are the future trends in token classification and regulation?

Ans: The future trends might head more toward hybrid tokens that mix features of both utility and security models. Many government sectors are also tightening and framing new frameworks, expanding the opportunities in the crypto market.